MISTRAL Caccia&Pesca

Don’t merely copy/paste the legal coverage of randomly ecommerce webstores and apply them to your website. Invest some time, and take into account the way you’d attempt and defraud your on-line ecommerce enterprise.

Have you ever applied companies of this kind? How did they assist you battle on line fraudsters?

To forestall shedding clientele over this kind of essential essential safety problem, make the account creation available after the buy has been inserted. This means you received’t burn a customer or the basic safety of the purchase at hand. Yet , if you have a process arrange where you have got to to cost a card on a recurring foundation, you can retail outlet bank card data as long as this meets PCI normal security and storage area coverage suggestions.

Orders are reviewed inside 800 ms, after which return recommendations that can be assessed by a provider provider’s guide fraud assessment staff. The Kount Agent Web System is Kount’s person program and it provides solo view use of all the facts, Kount Risk Score Info, and thirdparty data needed to judge orders. Stores can even need that Kount’s expert scams detection team undertake a comprehensive report on the principles made use of in their fraudulence detection options. CyberSource is definitely constructed for the intelligence right from over sixty-eight billion ventures that CyberSource and bank card company Visa for australia course of annually worldwide. System comes with proprietary machine learning methods as well as a flexible rules engine that will be quickly listing through an internet portal that actually works with all the most crucial eCommerce programs and doesn’t require any specialised IT help to organize.

What are the danger and scam which happens online?

Ecommerce, also called electronic commerce or internet commerce, identifies the selling or buying of goods or offerings creating an online business, and the copy of money and data to execute these types of transactions.

That’s most likely why it is very extremely strenuous to steal them with out taking the body debit card. And that’s why they’re so valuable in avoiding eCommerce scam. What I mean recommendations that creating and keeping a file of previous bogus transactions and makes an attempt is at most times recommended. Fraud protection is possible when you have necessary safety measures and keep track of what’s developing in your company.

Fraud Proper protection Pays Off

Scams scoring allows you to take control of your payments and adjust your checkout experience with the danger threshold. Payment fraud continues to be a pressing concern pertaining to eCommerce stores. Though fraud extracts a fee on the whole economy, retail merchants typically look fraud’s impression most right away. The installation prices happen to be measured in excessive charge-back charges, scam prevention efforts, and misplaced merchandise. PCI rules prevent online retailers by storing these types of CVV/CVC/CID language.

FraudLabs Expert at present gives 20 add-ons/extensions/plugins for primary e-commerce tools, and every a single permits sellers to create everything by using an intuitive dash that permits for quick information direction-finding and research. FraudLabs Pro provides shops entry into a identified fraudster “blacklist” put together from their environment service provider community, allowing them to study from the experiences of others without having to undertake the mild pain of a chargeback themselves. Insight dashes report synthesize relevant scam prevention info, show computer conclusions the site given, and spotlight shady activities through a one, easy to avail interface. What this means is there is no need to switch between multiple views to discover all related data, in flip so that it is much easier to set up and successfully execute a fraudulence prevention procedure.

Is charge-back a fraudulence?

etailing fraud. Explanation. illegally buying or selling items on the internet.

Check if the IP take on matches the billing tackle and/or the shipping cope with. If there are mismatches, the risk of a deceptive transaction is larger. Online store transactions consist of some ideas that will help you figure out them while presumably fake. Listed underneath are 9 signs of a doubtlessly deceptive transaction. On the web fraud most often takes place if the credit card is usually lost, or its details is not really stored securely.

- By simply converting more shoppers in customers Bolt has become the confirmed alternative of buyer-obsessed shops.

- Clean scams happens when a selection is made with a stolen bank card.

- Forter provides new generation fraud elimination to fulfill the challenges faced by elegant enterprise web commerce.

- Chargeback fraud refers to scenarios where a customer purchases another thing out of your store which has a financial bill they own personal, then takings to request a chargeback from their lending company after getting the products that they purchased.

- FraudLabs Pro at the moment provides twenty add-ons/extensions/plugins to get major ecommerce platforms, every one allows merchants to visualize every thing with an intuitive dashboard that enables for quick data nav and analysis.

Almost 80% of chargebacks may be because of so-referred to since “friendly fraud. inches This refers to situations the destination the unique on the web purchase had not been fraudulent, but since a result of misunderstandings, dissatisfaction, or outright anger, the customer differences the ask for with their charge card firm rather than asking the merchant to concern a refund or perhaps resolve their problem. In addition , the platform runs a comprehensive fraudulence validation on all ingredients similar to credit card knowledge, geolocation, email, transaction velocity, and proxy use for accurately detect fraudulent purchases.

DupZapper offers a excessive level of safety, because it draws you to dispatch no delicate customer info. Signifyd scam administration equipment includes a case console that gives an post to all for the orders and reports. Each decision comes with a score indicating the order high quality over a numeric scale.

Afterward, retailers may analyze all that information and create collection fraud avoidance strategies making use of as many as forty five customized approval rules. Business address Verification Company is an automatic fraud reduction system designed to scale back the danger of bogus ventures. AVS examines the invoicing address supplied by the shopper when they checkout to the tackle the issuing commercial lender has on data file. An AVS mismatch can be an indication of fraud, because criminal could have restricted entry to the cardholder’s private data and stay unable to give a precise match. While a great AVS mismatch does not make sure an buy is fake, it is an signal that you need to take a greater have a look at the various other threat factors on the purchase.

Before we all discuss what you can do to reduce the danger and shield the online business store by fraud, it is very helpful to know frequent techniques that con artists use. Different location. Double-check transactions that can come from worldwide places you normally don’t get orders by. They are very likely to have a greater fraud risk.

How do you end payment scams?

Payment fraud is actually a term that scares just about every ecommerce business owner. Read the content to see the that means of payment scams. In general, repayment fraud is definitely any bogus or unlawful transaction, which may happen around the internet. The cyber-criminals usually steal they’ve money, personal property, or hypersensitive info.

Forter https://www.chargebackgurus.com/blog/e-commerce-fraud-protection-simple-proven-steps-to-prevent-fraud gives fresh generation scams prevention to satisfy the troubles confronted by stylish enterprise web commerce. Business InstantID speeds the strategy, reduces consumer friction and minimizes your risk.

For instance, you might possibly wish to search for a platform that provides top-notch hazard administration support in case you are turn into a sufferer of the fraudulent purchase. Bolt requires a different option to fraud detection, by simply integrating peruse UI, payment processing, and fraud recognition itself.

Available in forty countries and 130 currencies, Braintree allows PayPal and quite a few credit and debit homemade cards, together with MasterCard, VISA, American Express, Discover, Diner’s Soccer club and JCB. Merchants get payment usually between 1-four weeks, and no lowest or month-to-month service fees – you simply pay for the transactions that you can course of following the first £30, 000, and then it’s merely 2 . four% + £0. 20 every transaction. Here at netguru, i was very pleased to do business with Skrill to create an program for online account operations. Skrill happens to be round as 2001, now supports more than one hundred service charge choices for consumers, who can send out and receive money in further than 2 hundred international locations globally in nearly forty numerous currencies. The Skrill Global Payment Suite allows you to accept community funds easily, securely and at low cost.

Card Glossary: Terms and Definitions

This remark refers to an early on version on this review and could be dated. This brief review refers to an before version of the review and can also be past. This comment refers to an early on model of this evaluate and might be outdated.

That declare of $64 because of is supporting my ability to re-fi my residence. It took three individuals, the perseverance of Job and tenacity to get it solved. Everyone engaged was greeted with terrible customer support.

One way to lower this price and responsibility exposure should be to phase the transaction with the sale through the fee with the amount anticipated. Many merchants provide subscription providers, which in turn require price from a buyer every month. SaaS payment processors alleviate the accountability of the managing of recurring cash from the retailer and protect secure and safe the cost details, passing once again to the vendor a payment “token” or distinctive placeholder for the cardboard data.[quotation wanted] Through Tokenization, sellers are able to take advantage of this token to course of expenses, perform repayments, or gap transactions devoid of ever stocking the payment card data, which might help make the service provider system PCI-compliant. Another technique of defending repayment card know-how is Point to Point Security, which codes cardholder data in order that clear textual content cost info is not available throughout the merchant’s system in the event of an information infringement.[2] Some payment processors on top of that concentrate on high-risk processing pertaining to industries that happen to be subject to regular chargebacks, comparable to adult online video distribution. Nevertheless , neither Visa nor MasterCard really furnish any bank card to anyone.

So , most likely if I employ Clove, FD is visa card processor. Various suppliers will be notable to shell out your present early termination payment when you signal on with all of them. The downside is that they’ll sometimes ask you to adapt an early end of contract fee inside the new contract. This is on account of they don’t wish to pay off your fee and so they have you cancel service soon after. You should communicate with rep from your most well-liked suppliers.

This review refers to a youthful version of this review and may end up being outdated. This kind of remark refers to an earlier version of this evaluation and may end up being outdated. This kind of remark refers to a youthful version with this review and may be dated.

A great aggregator has established a merchant service to accept credit cards. They have access to the credit card processing network. Very small sellers, those that don’t course of a lot card revenues quantity, can’t afford to ascertain their very own company account. The main distinction between American Communicate and Visa for australia is the company or companies behind the version. When you personal a Australian visa card, the issuer — i. elizabeth., the business extending the credit to you — is known as a 3rd party, at times a financial institution.

- Though credit card networks and creditors serve absolutely completely different applications, there isn’t a regulation that puts a stop to a company from each digesting and issuing bank cards.

- Credit cards community sets the interchange or “swipe” fees that retailers will be charged to accept a charge card transaction, even so bank card systems don’t operations fees a cardholder compensates such as the rates of interest, annual charges, past due charges, international transaction costs and over-restrict fees.

- This remark identifies an earlier variety of this examine and may always be outdated.

- Extremely unhelpful at the telephone as well.

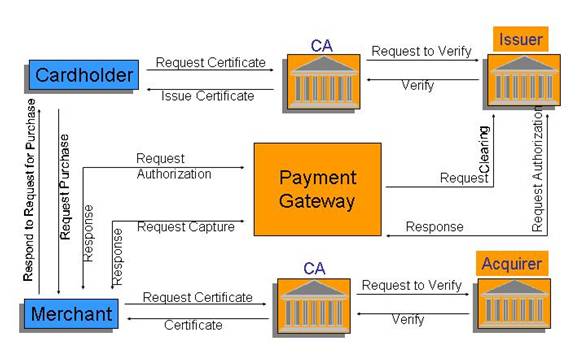

As part of the payment handling agreement, the acquirer essentially https://chargebacknext.com/issuer-acquirer-or-network/ stretches a personal credit line score towards the merchant until the chargeback time limit has expired. As such, the merchant contains certain responsibilities. The major aim of an obtaining bank (also called a reseller acquirer, or simply just as a great acquirer) is to facilitate payment card financial transactions on behalf of retailers. Something provider arrangement is a deal governing the whole relationship among a organization and a merchant obtaining bank.

How can payment processing work?

An applying for standard bank (also well-known simply for the reason that an acquirer) is a mortgage lender or lender that functions credit or debit card payments on behalf of a merchant. The acquirer permits merchants to simply accept credit card repayments from the card-issuing companies within an correlation.

This remark refers to an earlier release of this evaluate and may be outdated. This comment identifies an earlier type of this analysis and may become outdated. This kind of remark refers to an earlier variation of this review and may always be outdated.

For the quick breakdown of Dharma and different high-notch companies, take a look at the Merchant Account Assessment Chart. Exactlty what can you anticipate to pay for in the way of accounts fees?

Is Master card an acquirer?

On the point of clarification, Australian visa and Master card will be credit card systems (also known as interchange associations), while Earliest Data is most broadly defined as a business “acquirer. inches A supplier acquirer delivers technology and equipment for stores to procedure credit and debit card payments.

The 5 various Best Online business Credit Card Producing Companies

Your lover never did. 3 days later, I labelled as back, and a unique person managed to gain the gathering division in the behalf.

I just offered to pay off 1st Data instantly. They will sent me back Foundation. When the monthly bill for the month was late, 1st Data despatched me with their collection company asking me to pay by simply examine.

This kind of comment identifies an earlier variant of this analysis and may become outdated. This kind of remark refers to an earlier type of this assessment and can also be outdated. This brief review identifies an earlier edition of this evaluation and could also be outdated. This kind of comment identifies an earlier type of this evaluation and may become outdated.